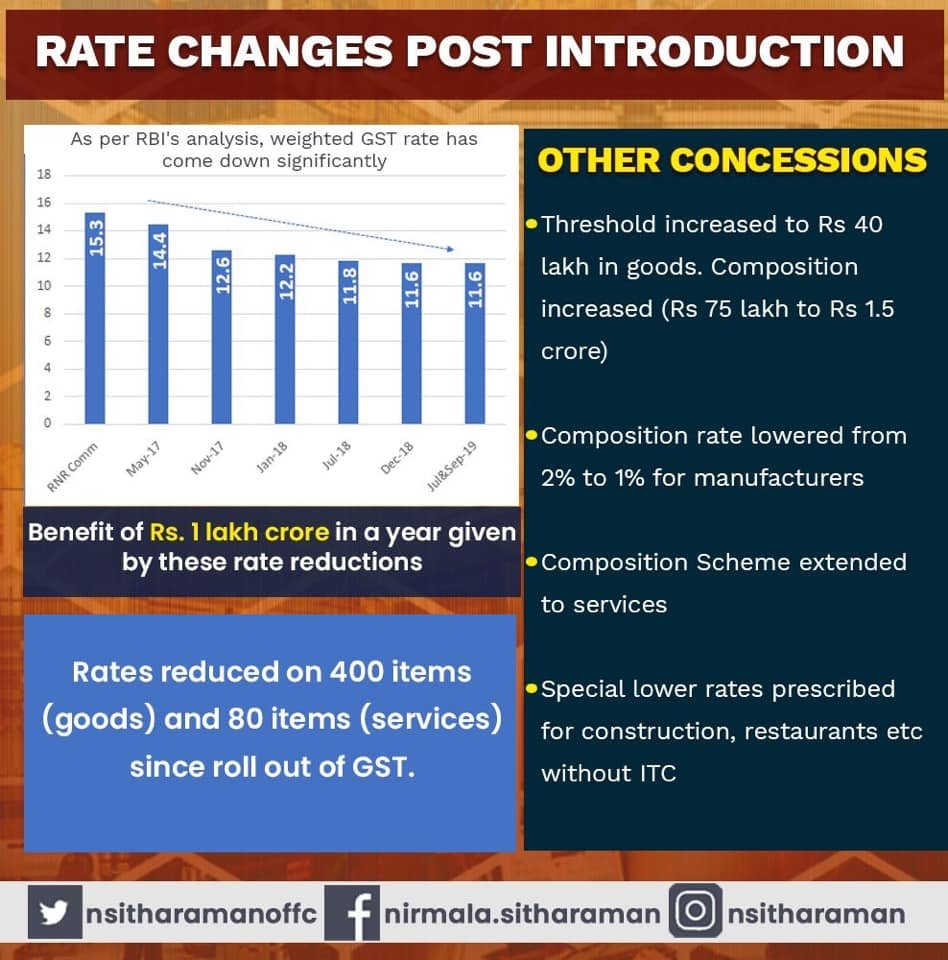

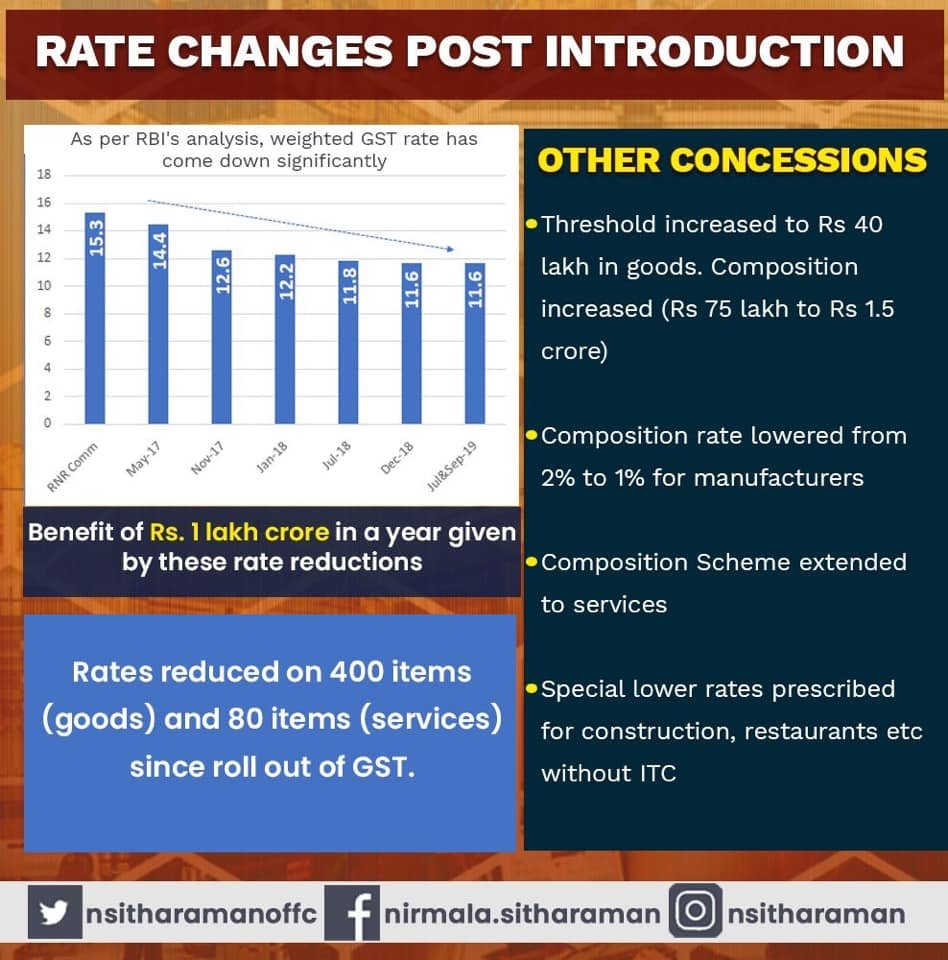

Now, the exemption limit of annual turnover for GST has been raised to Rs 40 Lakh from Rs 20 Lakh.

Additionally, those with a turnover up to Rs 1.5 crore can opt for the Composition Scheme and pay only 1% tax.

Email: officeofarvindd@gmail.com | Support: 040 – 35232111

Email: officeofarvindd@gmail.com | Support: 040 – 35232111

Now, the exemption limit of annual turnover for GST has been raised to Rs 40 Lakh from Rs 20 Lakh.

Additionally, those with a turnover up to Rs 1.5 crore can opt for the Composition Scheme and pay only 1% tax.

India’s booming creator ecosystem is on track to drive over USD 1 trillion in annual consumer spending by 2030,...

In response to the brutal terrorist attack in Pahalgam, Jammu and Kashmir, on April 22, 2025—which claimed the lives...

India has achieved a major breakthrough in hypersonic propulsion technology with the successful 1000-second ground...